Maximize Cash Flow with Reverse Factoring

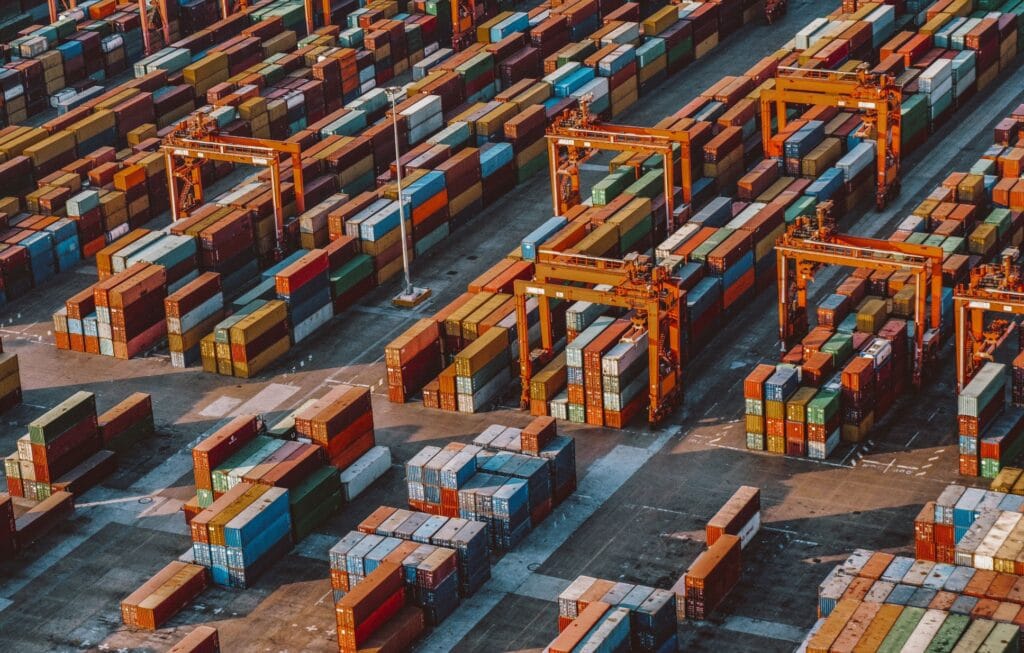

Strengthen your supply chain with accelerated payments and favorable terms.

Factoring fee as low as 1%

For companies with annual revenues of +$20M

SCF lines from $500K up to $2MM

Factoring fee as low as 1%

For companies with annual revenues of +$20M

SCF lines from $500K up to $2MM

How Reverse Factoring Enhances Cash Flow and Strengthens Supply Chains

Reverse factoring helps businesses optimize their cash flow and strengthen their supplier relationships. With reverse factoring, the buyer initiates the process by arranging financing for their suppliers, allowing them to receive early payment for their invoices. This mutually beneficial arrangement creates a win-win situation. Suppliers gain access to quick and reliable cash flow, enabling them to improve working capital, invest in growth opportunities, and manage their operations more efficiently. For the buyer, reverse factoring extends payment terms without negatively impacting suppliers, fostering stronger supplier relationships and ensuring a more robust and stable supply chain. By leveraging the benefits of reverse factoring, businesses can optimize their cash flow, enhance collaboration with suppliers, and achieve sustainable growth in today’s competitive marketplace.

How Reverse Factoring Enhances Cash Flow and Strengthens Supply Chains

Reverse factoring helps businesses optimize their cash flow and strengthen their supplier relationships. With reverse factoring, the buyer initiates the process by arranging financing for their suppliers, allowing them to receive early payment for their invoices. This mutually beneficial arrangement creates a win-win situation. Suppliers gain access to quick and reliable cash flow, enabling them to improve working capital, invest in growth opportunities, and manage their operations more efficiently. For the buyer, reverse factoring extends payment terms without negatively impacting suppliers, fostering stronger supplier relationships and ensuring a more robust and stable supply chain. By leveraging the benefits of reverse factoring, businesses can optimize their cash flow, enhance collaboration with suppliers, and achieve sustainable growth in today’s competitive marketplace.

Win-win solutions for smart companies

Industry experience

We've spent more tha 20 years working with B2B Small and Medium Businesses in the US.

A dedicated account executive will see to all aspects of your factoring line.

How does it work?

Suppliers Deliver & Issue Invoice

Supplier Chooses Early Payment

You Set Up the Program

You Pay Later on Agreed Terms

You Set Up the Program

Suppliers Deliver & Issue Invoice

Supplier Chooses Early Payment

You Pay Later on Agreed Terms

When is the right time to

consider factoring?

High-growth opportunity

Your sales are growing faster than your cash flow.

Clients with extended payment terms

High sales concentration with few customers

How our clients feel about us

How our clients

feel about us

Exclusive services for our clients

With purchase order financing and inventory financing, you’ll be able to deliver more, seize bigger opportunities and larger orders, and grow your business faster.

Inventory finance

Leverage your inventory to improve your cash flow

Purchase order finance

Secure your production without compromising your capital

Up to 70%

of your inventory/PO

Up to 30%

of the outstanding factoring line

Up to 30%

of the outstanding factoring line