Maximize cash flow with Invoice Factoring

Sell your accounts receivable. Get paid faster. Say goodbye to the risk of non-payment.

Initial set-up as quick as 7 business days

Factoring fee as low as 1%

Funding within 24 hours

Facilities from $500k up to $10 million

Initial set-up as quick as 7 business days

Factoring fee as low as 1%

Funding within 24 hours

Facilities from $500k up to $10 million

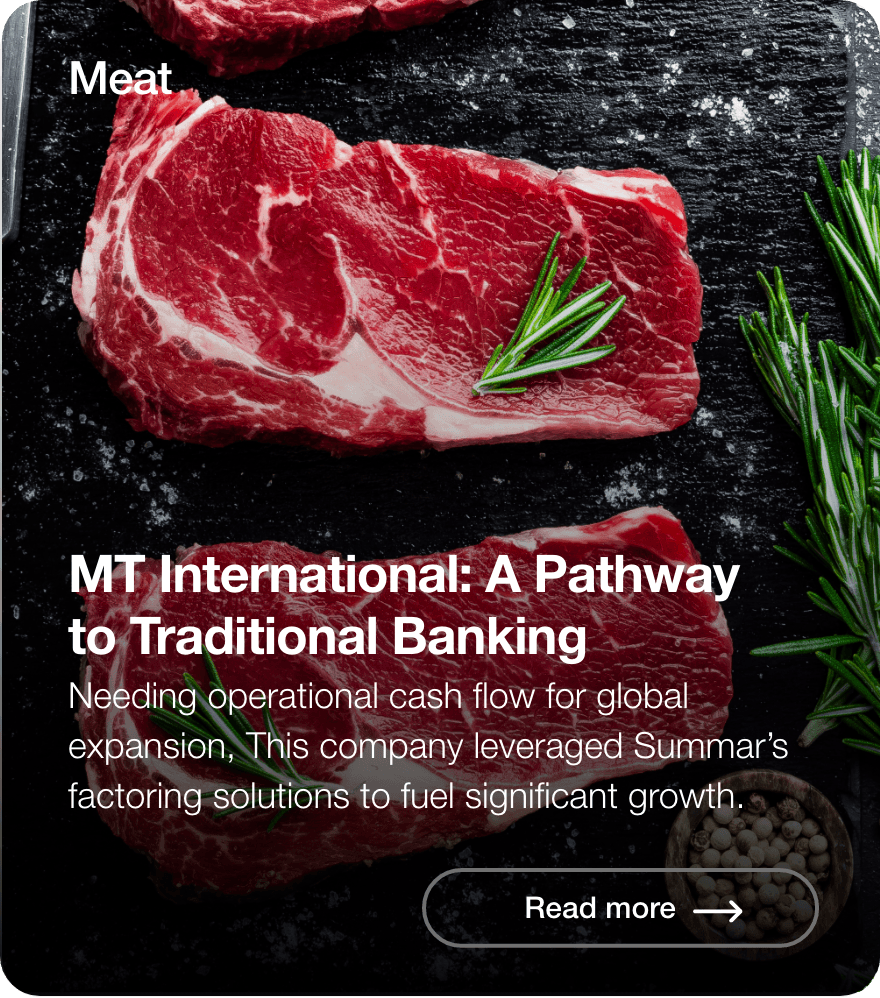

Navigating Seasonal Trends with Invoice Factoring

Invoice factoring is a valuable tool for addressing seasonal fluctuations in demand, supply chain disruptions, and cash flow gaps. With factoring services, you can convert outstanding invoices into immediate cash, ensuring a consistent working capital to sustain operations during slow seasons. This allows you to meet payroll, cover expenses, and seize new opportunities, regardless of seasonal revenue fluctuations.

Factoring offers the flexibility to adjust your financing needs based on seasonal demands. You can factor invoices selectively during peak seasons and scale back during slower periods. By effectively managing seasonal trends through factoring, you can optimize cash flow, bridge revenue gaps, and ensure continued growth and success.

Navigating Seasonal Trends with Invoice Factoring

Invoice factoring is a valuable tool for addressing seasonal fluctuations in demand, supply chain disruptions, and cash flow gaps. With factoring services, you can convert outstanding invoices into immediate cash, ensuring a consistent working capital to sustain operations during slow seasons. This allows you to meet payroll, cover expenses, and seize new opportunities, regardless of seasonal revenue fluctuations.

Factoring offers the flexibility to adjust your financing needs based on seasonal demands. You can factor invoices selectively during peak seasons and scale back during slower periods. By effectively managing seasonal trends through factoring, you can optimize cash flow, bridge revenue gaps, and ensure continued growth and success.

Faster payments and top-quality service to scale your business

Industry experience

We've spent more tha 20 years working with B2B Small and Medium Businesses in the US.

We’ll be your credit department

We’ll run credit checks of your buyers and insure your accounts receivable.

Above and beyond service

You get a dedicated account executive to manage all of your funding and collections.

How does it work?

We’ll check your buyer’s credit. You’ll grow at the speed of your sales, not your financial capacity

Submit your invoices

Apply online, call us, or have us call you

Receive up to

90%

Apply online, call us, or have us call you

We’ll check your buyer’s credit. You’ll grow at the speed of your sales, not your financial capacity

Submit your invoices

Receive up to

90%

When is the right time to

consider factoring?

High-growth opportunity

Your sales are growing faster

Clients with extended payment terms

High sales concentration with few customers

How our clients feel about us

How our clients

feel about us

Exclusive services for our clients

With purchase order financing and inventory financing, you’ll be able to deliver more, seize bigger opportunities and larger orders, and grow your business faster.

Inventory finance

Leverage your inventory to improve your cash flow

Purchase order finance

Secure your production without compromising your capital

Up to 70%

of your inventory/PO

Up to 30%

of the outstanding factoring line

Up to 30%

of the outstanding factoring line